It’s September 22nd, 2025. You step into your local store, and the shampoo you always buy suddenly costs less. That refrigerator you’ve been putting off? Now it fits your budget. Even your online orders look different, the invoice, the tax rate, the final amount.

This isn’t luck. This is GST 2.0, India’s biggest tax shake-up since the first GST launch. And it’s going to ripple through every corner of the economy, whether you’re a shopper, a business owner, or part of a supply chain that keeps the country moving.

So, what exactly is GST 2.0? It’s the government’s next-generation tax reform, finalized during the 56th GST Council meeting. In simple words, GST 2.0 is a revamped tax structure designed to simplify compliance, lower costs for consumers, and spark demand across industries. How? By merging the old slabs (5%, 12%, 18%, 28%) into just two main rates, 5% and 18%, plus a 40% bracket for luxury and sin goods. It also removes the long-criticized compensation cess and brings down taxes on essentials like healthcare, insurance, and daily household items.

This blog will unpack everything you need to know, What GST 2.0 really changes, How it will affect prices, margins, and consumer behavior, Why logistics and order channels are at the heart of this transition. And most importantly, how your business can stay ready and thrive.

GST 2.0 Price Changes

India’s GST 2.0 overhaul, brings sweeping changes that will reshape the way we shop, pay, and do business. While many everyday items are now significantly more affordable, some goods continue to carry higher taxes, reflecting the government’s careful balance between easing costs for consumers and maintaining revenue from luxury and sin products.

What Gets Cheaper

Household Essentials: Everyday necessities like packaged food, soaps, and cleaning products now attract a uniform 5% GST, down from the earlier 12–18%. This reduction delivers immediate relief for millions of households and is expected to fuel demand in the fast-moving consumer goods (FMCG) sector, helping families stretch their budgets further without compromising on quality.

- Appliances: Big-ticket household appliances, air conditioners, refrigerators, washing machines, have seen their GST drop from 28% to 18%. This welcome reduction is poised to drive higher sales, especially among India’s growing middle-class households, making home upgrades more accessible than ever.

- Freight Services: Logistics and transport costs also get a boost, with GST on freight services slashed from 12% to 5%. This move not only lowers the cost of moving goods across the country but also enhances efficiency in the supply chain, benefiting businesses and consumers alike.

What Doesn’t Get Cheaper

- Luxury and Sin Goods: Products like tobacco, liquor, and pan masala continue to carry the highest GST rate of 40%. By maintaining steep taxes on these items, the government seeks to discourage harmful consumption while sustaining critical revenue streams.

- These changes showcase a carefully calibrated tax reform, one that relieves financial pressure on everyday consumers, encourages spending in key sectors, and ensures that taxes remain high on non-essential or harmful products. GST 2.0 is not just a reform; it’s a strategic move to stimulate demand, simplify compliance, and strengthen the economy.

Why GST 2.0 Is a Game-Changer for Businesses and Trade

GST 2.0 is more than just a tweak in tax rates; it’s a game-changing reform that affects how money, goods, and services flow across India. From lowering taxes on everyday essentials to reshaping slabs for appliances and luxury items, this overhaul sends ripples throughout supply chains, retail markets, and consumer behavior.

For everyday shoppers, the impact is immediate. Packaged foods, cleaning products, and even electronics have become noticeably more affordable. For households, especially in rural areas and middle-income segments, this means stretching budgets further and feeling a real difference in daily expenses. Lower prices often spark more spending, boosting demand in sectors that depend on consistent consumer activity.

Businesses, meanwhile, must adapt quickly. Pricing strategies, profit margins, and marketing campaigns all need recalibration. Stock with old GST labels must be managed carefully, and retailers or eCommerce platforms need to update invoicing, accounting, and order management systems to keep in step with the new rates.

At a bigger picture level, GST 2.0 could gently but meaningfully boost the economy. Lower taxes on essentials give consumers more disposable income, while sectors like consumer durables, electronics, and logistics could see a surge in demand. Experts say this reform, by simplifying compliance and cutting costs, could act as a powerful stimulus for economic growth and consumption.

In short, GST 2.0 isn’t just a policy update, it’s a smart, demand-driven reform, designed to make life easier for consumers, streamline business operations, and energize the broader economy. It’s a reminder of how closely taxation, commerce, and everyday life are intertwined in modern India.

Logistics: The Backbone of Change

While most discussions around GST 2.0 highlight tax slabs, compliance, and consumer pricing, one of the most critical yet often overlooked factors is logistics. Efficient logistics form the backbone of GST 2.0, ensuring that goods move seamlessly across states with reduced bottlenecks, faster transit times, and streamlined documentation. By simplifying supply chain operations and minimizing delays at checkpoints, logistics not only supports businesses in cutting costs but also enhances the overall customer experience. In many ways, it is the silent driver powering the real success of GST 2.0.

Lower Costs, Higher Efficiency

India’s logistics sector is undergoing a major transformation, driven by structural and policy reforms. GST 2.0, digitalization, and improved infrastructure are reducing inefficiencies and enabling faster movement of goods. Together, these changes are reshaping supply chains and strengthening India’s position in global trade.

- Reduction in GST on freight services: The tax rate on multimodal transport, excluding air transport, has been cut from 12% to 5%. This move aims to reduce logistics costs across industries, making freight movement more cost-efficient and supporting the broader logistics and supply chain sectors.

- Decreased GST on vehicle parts and spares: Components used in manufacturing motor vehicles, such as auto parts, have seen their GST reduced to 18%, down from 28%. This reduction is expected to lower vehicle running costs for fleet operators and make transport inputs more affordable for MSME operators.

These changes are not just about numbers, they’re about empowering businesses to operate more efficiently and cost-effectively.

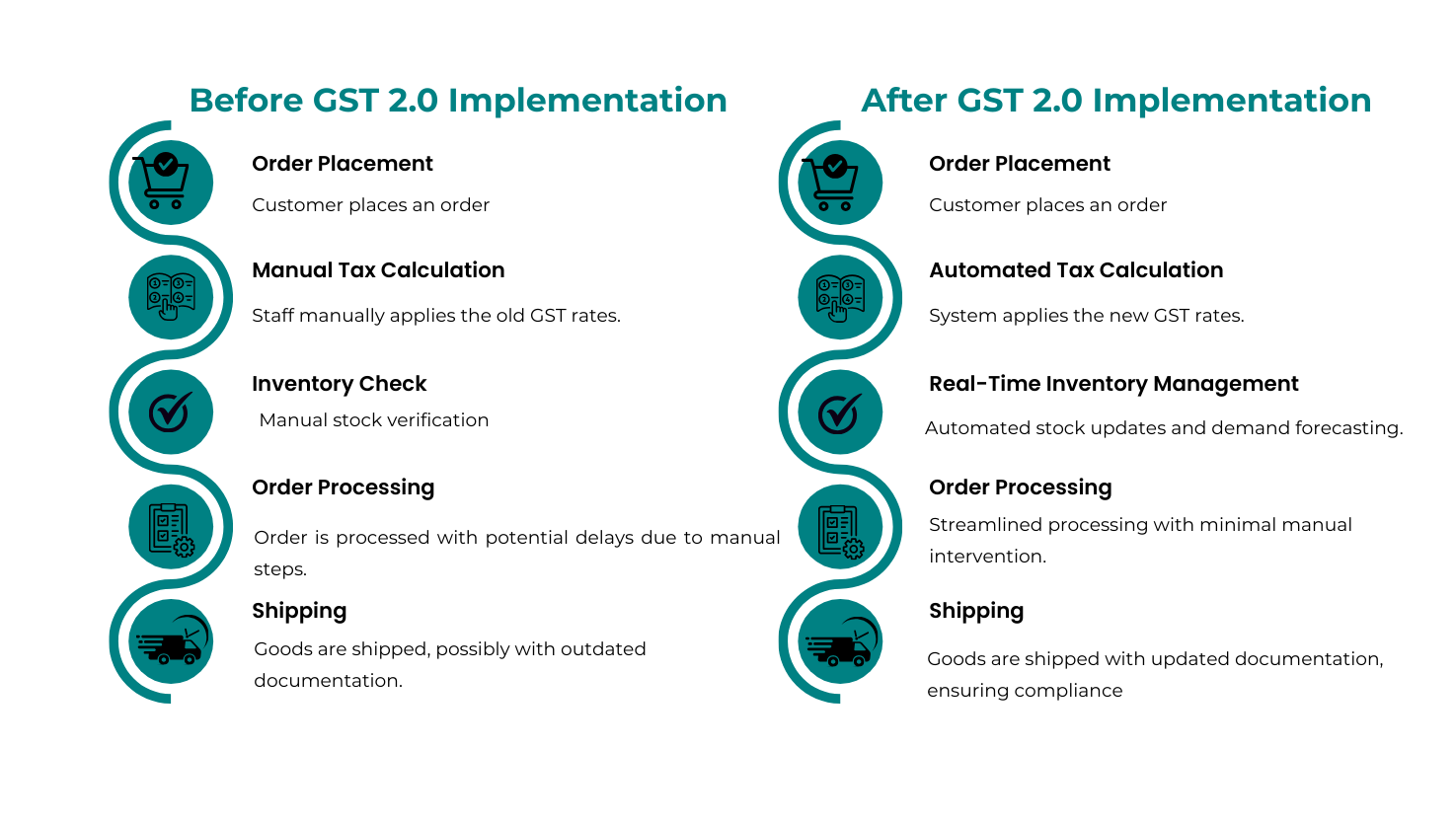

Why Businesses Need Updated Order Channels in 2025

With these tax adjustments, businesses must ensure their order channels are aligned with the new GST framework. Here’s why:

- Accurate Tax Calculation: Updated systems ensure that the correct GST rates are applied to each transaction, preventing errors and potential compliance issues.

- Efficient Inventory Management: Real-time updates help in tracking stock levels, managing orders, and forecasting demand accurately.

- Streamlined Invoicing and Documentation: Automated systems generate invoices that reflect the correct tax rates, reducing manual errors and administrative workload.

- Enhanced Customer Experience: Timely and accurate order processing leads to faster deliveries and improved customer satisfaction.

Keeping your order channels updated ensures smooth operations, accurate invoicing, and timely deliveries. It reduces errors, helps manage inventory efficiently, and keeps your business compliant, all while improving the customer experience.

Transform Your Order Channels for Seamless Efficiency

GST 2.0 is set to reshape the way India buys, sells, and moves goods. With simplified tax slabs and adjusted rates, essentials are becoming more affordable, businesses must adapt fast, and the economy is gearing up for a boost. This isn’t just a policy update, it’s a shift that touches everyone, from everyday shoppers to the smallest supply chains.

Why Updating Order Channels and Logistics Matters

1. Invoices Must Reflect New GST Rates

Getting invoices right is crucial. Applying outdated GST rates can lead to penalties, delays, or even blocked shipments. Accurate invoicing ensures smooth operations and compliance.

2. Courier and Shipping Labels Must Sync

Shipping labels aren’t just for delivery, they carry tax information. If they’re outdated, shipments can be delayed or rejected. Coordination with logistics partners ensures goods move smoothly and on time.

3. ERP, OMS, WMS, and TMS Systems Need Updates

Enterprise systems are the backbone of operations. Updating them automates tax calculation, inventory tracking, and order processing, reducing errors and saving time.

4. Inventory Transition Management

Stock purchased under old GST rates must be managed carefully to avoid billing discrepancies. Updated systems help businesses bill correctly and remain compliant.

5. Seamless Transportation Is Key

Keeping order channels updated ensures shipments move without interruptions, costs stay low, and customers get their orders on time and accurately billed. It’s about efficiency, trust, and a smooth business flow.

GST 2.0 is more than a tax change, it’s a game-changer for commerce in India. Businesses that update systems and streamline logistics will not only stay compliant but also gain operational efficiency and customer trust. For consumers, it means cheaper essentials and smoother shopping experiences. Acting proactively is the key to thriving in this new era.

A Quick Checklist for Businesses to Navigate GST 2.0

Updating your business for GST 2.0 doesn’t have to be overwhelming if you follow a structured approach. Here’s a practical checklist to ensure smooth operations and compliance:

Review Your Product List by GST Category

Start by going through every product or service you offer and categorize it according to the new GST slabs. This helps identify which items have lower taxes, which remain in higher brackets, and which may require updated pricing. Clear categorization ensures accurate invoicing and compliance.

Update Pricing Across All Sales Channels

Make sure that the new prices are reflected consistently everywhere, your physical stores, eCommerce platforms, online marketplaces, and even social media sales channels. Consistent pricing avoids confusion, builds trust with customers, and prevents billing errors.

Communicate Clearly with Customers

Transparency is key. Inform your customers about price adjustments, whether reductions on essentials or unchanged rates on luxury items. Clear communication not only builds trust but also helps manage customer expectations and avoids disputes at checkout.

Train Your Staff on Handling Invoices and Returns

Your team needs to understand the changes to GST rates and how to apply them correctly in invoices, receipts, and returns. Proper training reduces errors, ensures smooth daily operations, and improves customer experience.

Sync Your Logistics, OMS, and ERP Systems for Auto-Compliance

Ensure all operational systems, order management, warehouse, and transport software, are updated to handle the new GST rates automatically. This reduces manual intervention, prevents delays, and keeps shipments and accounting accurate, ultimately keeping your business efficient and complaint-free.

Navigating GST 2.0 may seem daunting, but with the right preparation, businesses can turn compliance into an opportunity for efficiency and growth. By following this checklist, you can stay ahead of tax changes, optimize pricing strategies, and ensure smooth operations. Staying proactive now will not only prevent surprises but also position your business to thrive in India’s evolving GST landscape.

Agility Is Profitability

GST 2.0 isn’t just another tax update, it’s a reset button for Indian commerce. For consumers, it’s a sigh of relief. For businesses, it’s both an opportunity and a test.

The winners will be those who don’t just comply but adapt quickly, updating systems, recalibrating logistics, and passing on benefits to customers without missing a beat.

So, as September 22 approaches, ask yourself: Is my business ready to move as fast as the new GST rates demand?