In 2025, US ecommerce sales crossed $1.1 trillion, but that growth wasn’t evenly distributed. A small group of platforms now handles millions of orders every day, running fulfillment and delivery networks that resemble national infrastructure more than traditional retail operations.

What makes this moment worth examining is not just who leads the market, but how differently each platform competes. Some win through delivery speed, others through depth of assortment or category focus, while a few succeed by mastering niche segments with remarkable consistency. Behind the scenes, technology, logistics coordination, and post-purchase experience have become just as important as pricing or brand recognition.

With customer expectations rising and competition intensifying, understanding how ecommerce leaders operate has never been more relevant. This blog takes a closer look at 10 ecommerce platforms shaping online retail in the US, exploring what drives their success and what their strategies signal for the future of global ecommerce.

Why the US Ecommerce Landscape Sets Global Direction

The US ecommerce market plays a unique role in shaping how online retail evolves worldwide. Its size, competitive intensity, and customer maturity create an environment where new ideas are tested under real pressure. What works here tends to scale; what doesn’t fades quickly. As a result, the strategies adopted by leading US platforms often become reference points for global ecommerce growth.

A market where innovation is tested at scale

With millions of daily transactions and high operational complexity, the US market exposes strengths and weaknesses faster than most regions. Same-day delivery, flexible return policies, and hybrid fulfillment models didn’t emerge in isolation, they were refined through constant iteration. Platforms that survive this environment do so by building systems that can handle volume without breaking.

Customer expectations have permanently shifted

US shoppers now evaluate ecommerce brands on consistency rather than promises. Accurate delivery timelines, proactive communication, and simple returns are expected as standard. Reliability has become a key driver of repeat purchases, making post-checkout experience just as important as product discovery or pricing.

Logistics is moving from fragmented to platform-led

Leading platforms are consolidating logistics operations into integrated networks. By coordinating warehousing, carrier allocation, and last-mile delivery within unified systems, they gain better visibility and control. This approach reduces delivery failures, improves peak-season performance, and allows platforms to respond faster to demand changes.

Marketplaces are becoming full commerce ecosystems

Ecommerce platforms are no longer just transactional spaces. They now provide sellers with tools for payments, advertising, analytics, and fulfillment. This ecosystem model lowers operational friction for merchants while strengthening platform dependency, creating more stable and scalable growth.

The practices that succeed in the US often shape ecommerce expectations globally. For brands planning scale, entering new markets, or managing cross-border operations, these patterns offer early insight. Understanding how US leaders operate helps businesses prepare for the next phase of ecommerce, before those standards become unavoidable elsewhere.

The 10 Platforms Defining Online Retail at Scale

The Top 10 ecommerce platforms highlighted in this blog are compiled by evaluating overall US ecommerce market share, operational scale, and category influence, using consolidated insights from industry analyses and market performance data. This list aligns closely with findings from the 2025 US Ecommerce Market Share Report by SellersCommerce, which outlines how a small group of platforms continue to dominate online retail through volume, infrastructure, and fulfillment strength. Together, these factors provide a grounded, data-backed view of the platforms that currently define ecommerce leadership in the United States.

| Ecommerce Platform | Core Strength | Estimated US Ecommerce Market Share (%) | What Sets It Apart at Scale |

| Amazon | Speed and volume leadership | ~37.6% | Owns fulfillment, last-mile delivery, cloud infrastructure, and seller tools to control the end-to-end customer experience |

| Walmart | Omnichannel convenience | ~6.4% | Uses physical stores as fulfillment hubs, enabling fast pickup, local inventory access, and price-driven convenience |

| eBay | Seller-first marketplace | ~3.6% | Strong presence in resale, collectibles, and refurbished goods, making it resilient in niche and price-sensitive segments |

| Target | Brand-led ecommerce | ~1.9% | Strong presence in resale, collectibles, and refurbished goods, making it resilient in niche and price-sensitive segments |

| Best Buy | Category specialization | ~1.3% | Maintains relevance through expert service, controlled electronics inventory, and installation support |

| Costco | Loyalty-driven commerce | ~1.6% | Membership model, limited assortment, and value pricing translate effectively to bulk-focused online buying |

| Home Depot | Complex purchase enablement | ~1.7% | Supports project-based shopping with flexible delivery and contractor-focused services |

| Wayfair | Large-item logistics | ~1.0% | Specializes in bulky goods using supplier coordination, delivery scheduling, and visual product discovery |

| Etsy | Differentiated marketplace | ~0.9% | Focuses on handmade and custom goods, driven by storytelling, creator communities, and uniqueness |

| Apple (Online Store) | Ecosystem-led retail | ~3.6% | Tight control over inventory, pricing, and post-purchase support enables a premium digital buying experience |

Each platform succeeds in a different way, but all are built on operational consistency. That consistency is what separates short-term growth from sustainable leadership.

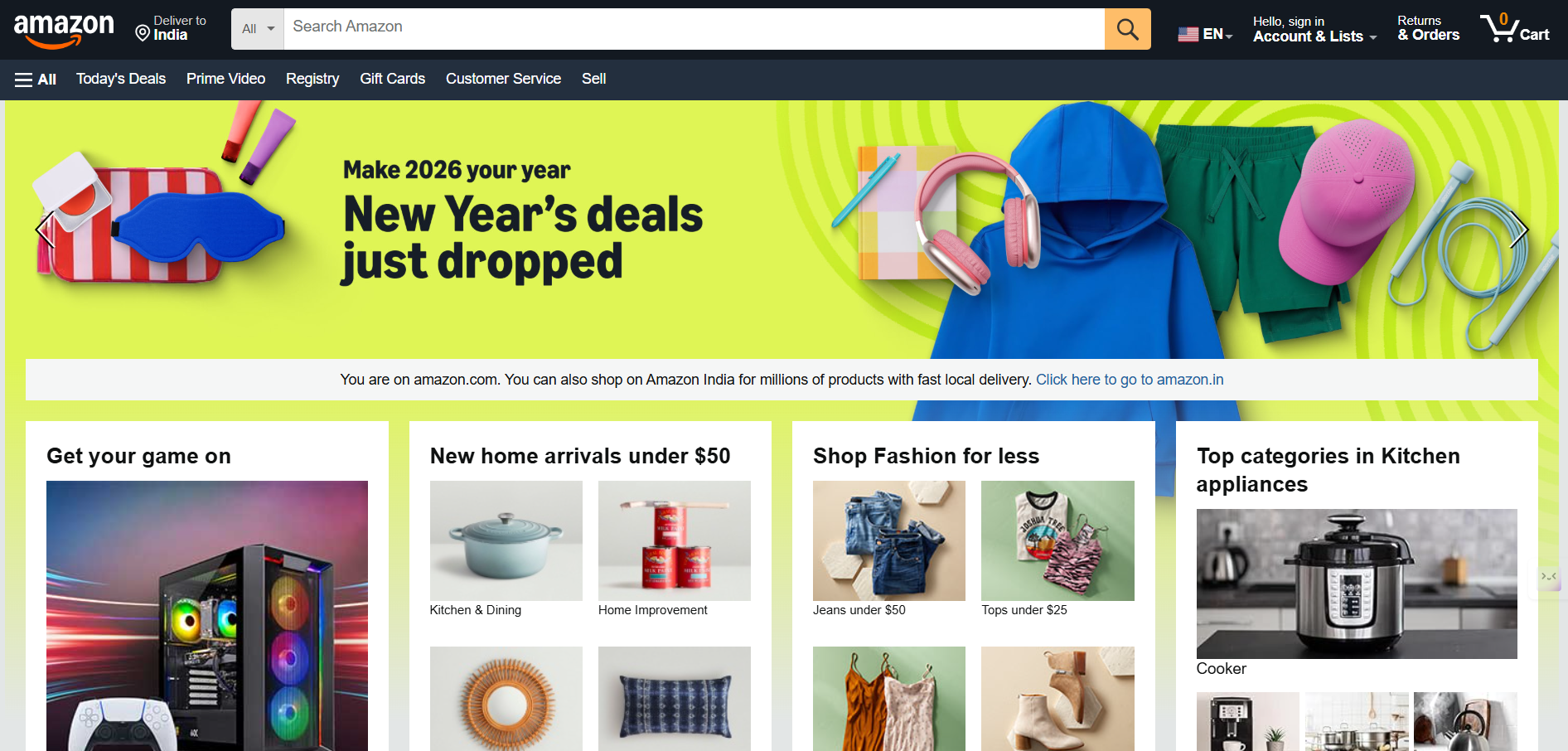

Amazon

Amazon is a large-scale online marketplace built to handle massive product variety and high order volumes. It connects consumers, third-party sellers, and logistics partners through tightly integrated systems designed for speed, reliability, and reach.

Key Features

- Operates an end-to-end fulfillment network that includes warehousing, sorting centers, and last-mile delivery, allowing tight control over delivery speed and reliability.

- Enables same-day and next-day delivery across major regions through regional hubs and demand forecasting systems.

- Provides sellers with integrated tools for inventory management, pricing, advertising, and performance tracking at scale.

- Uses advanced data and machine learning models to forecast demand and optimize inventory placement.

- Runs its ecommerce operations on scalable cloud infrastructure that supports peak traffic and order surges.

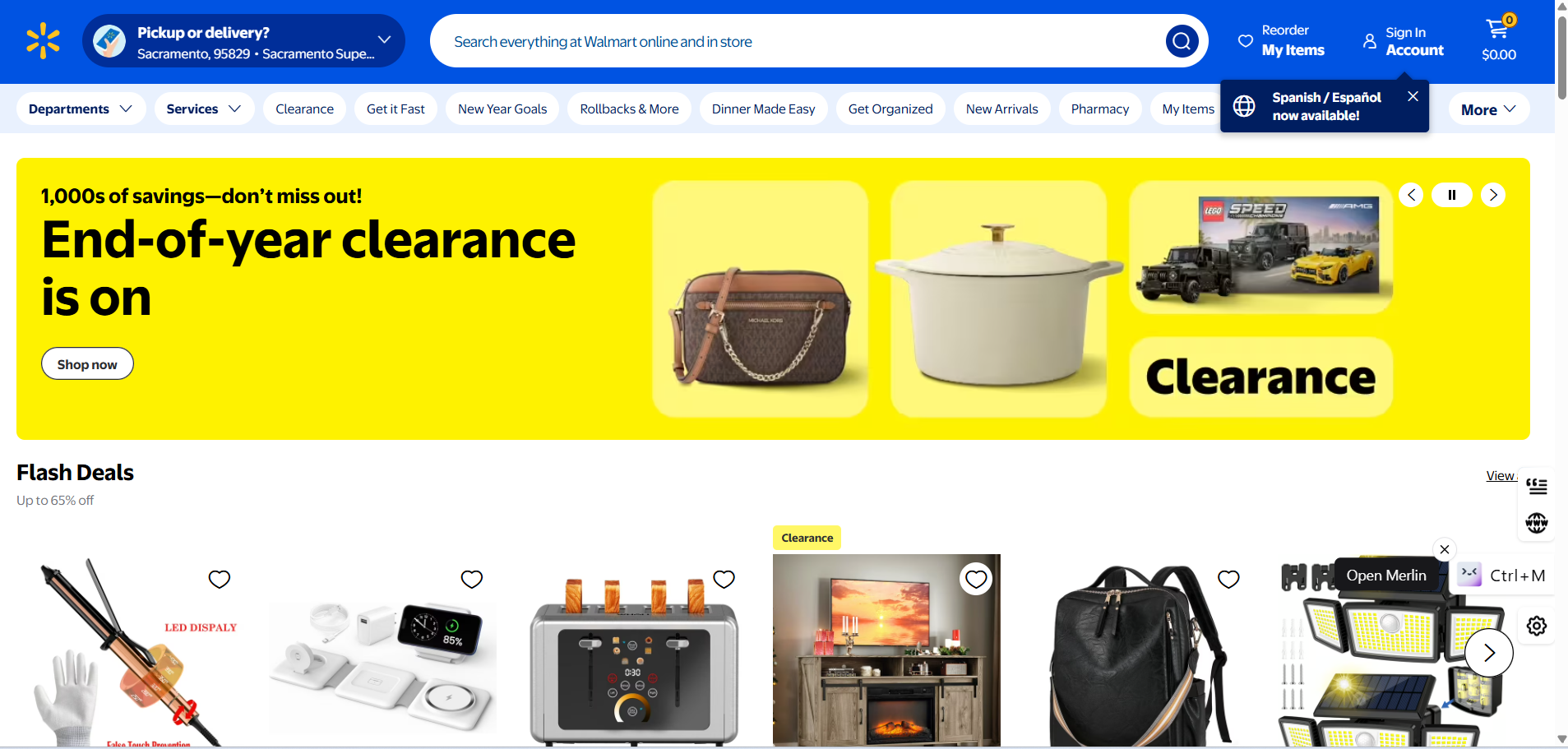

Walmart

Walmart’s ecommerce platform is an extension of its physical retail footprint. It combines online shopping with store-led fulfillment to offer convenience, affordability, and wide geographic coverage.

Key Features

- Uses its nationwide store network as fulfillment centers, reducing delivery time and improving local availability.

- Offers multiple fulfillment options such as curbside pickup, in-store pickup, and home delivery for customer convenience.

- Integrates real-time store inventory with online listings to improve order accuracy and availability.

- Maintains competitive pricing through efficient supply chain management and large purchasing power.

- Supports a unified shopping experience across physical stores, website, and mobile app.

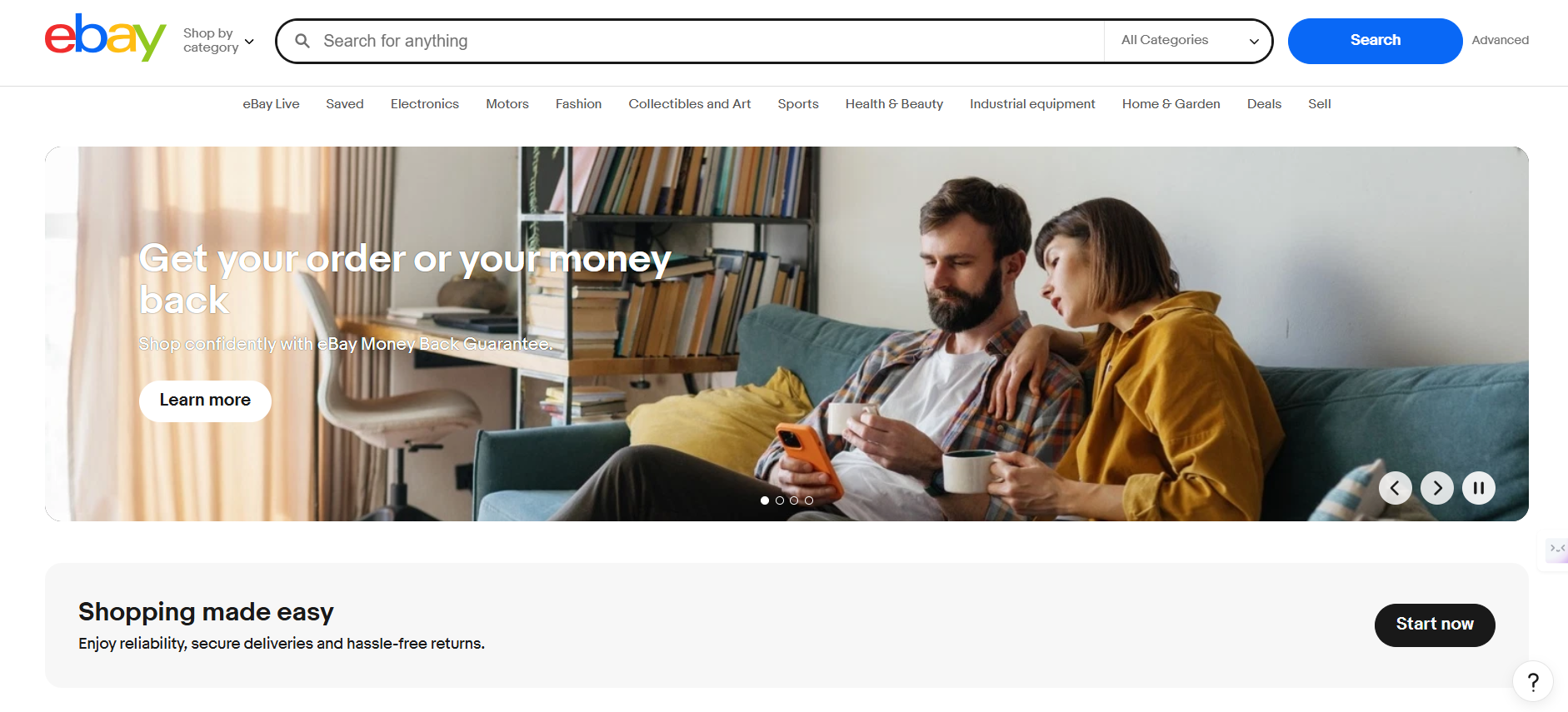

eBay

eBay operates as a global, seller-first marketplace rather than a traditional retailer. It enables individuals and businesses to sell directly to consumers across a wide range of categories.

Key Features

- Operates a seller-first marketplace model that allows individuals and businesses to sell directly to consumers.

- Supports multiple selling formats, including auctions and fixed-price listings, offering flexibility across categories.

- Has a strong ecosystem for resale, refurbished, and collectible items, making it resilient during price-sensitive demand cycles.

- Enables cross-border trade by connecting global buyers and sellers through localized experiences.

- Relies on seller-managed fulfillment while providing tools for trust, payments, and dispute resolution.

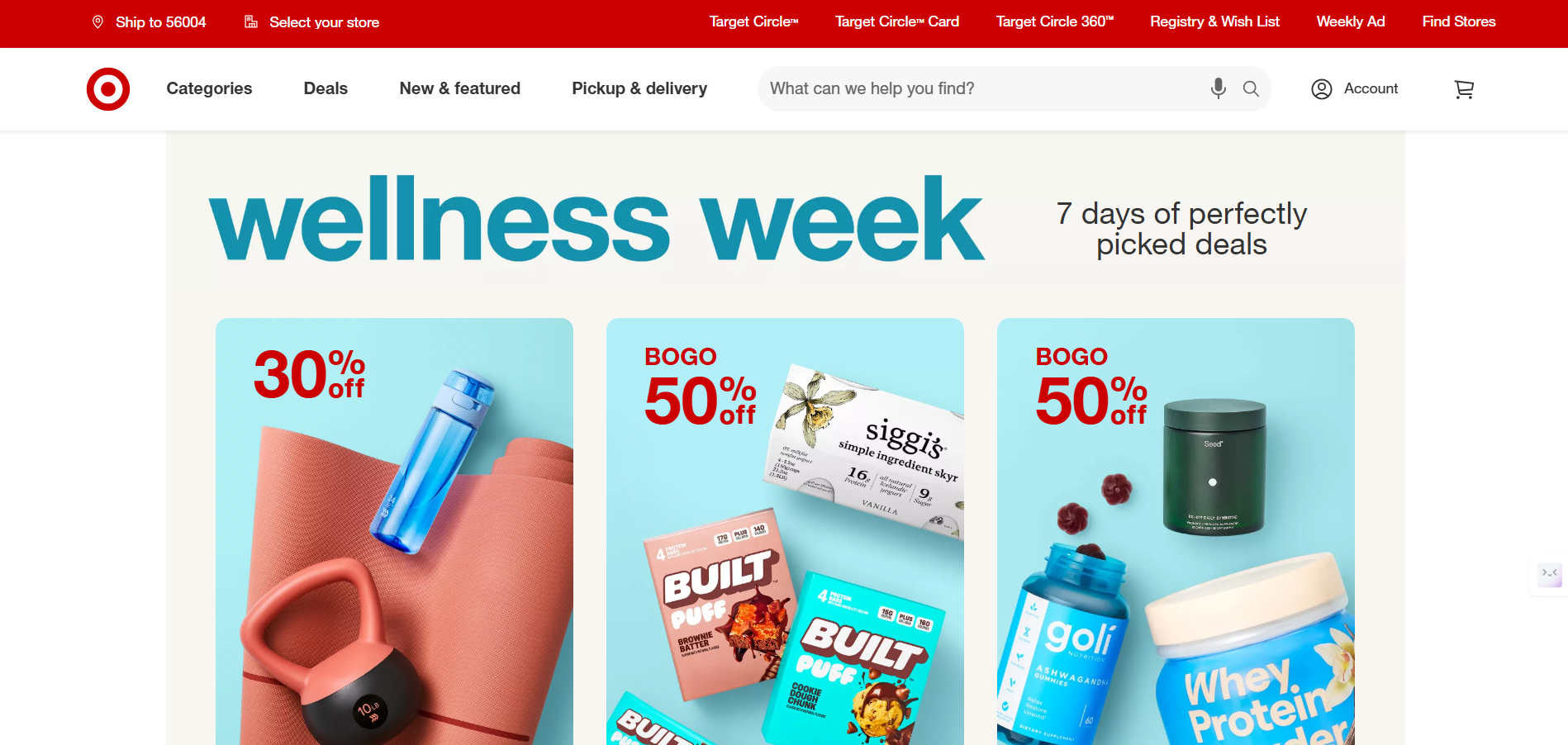

Target

Target’s ecommerce presence focuses on extending brand trust into digital commerce. It emphasizes curated assortments and a consistent shopping experience across online and offline channels.

Key Features

- Extends its offline brand trust into ecommerce through a curated product assortment and strong private labels.

- Provides same-day and curbside pickup options by leveraging store-based fulfillment.

- Maintains a consistent customer experience across online and offline touchpoints.

- Focuses on design-led assortments that balance quality, pricing, and accessibility.

- Offers reliable return and customer support processes to reinforce trust.

BestBuy

Best Buy’s ecommerce platform is built around high-consideration product categories. It combines online purchasing with expert guidance and post-purchase support.

Key Features

- Operates an end-to-end fulfillment network that includes warehousing, sorting centers, and last-mile delivery, allowing tight control over delivery speed and reliability.

- Enables same-day and next-day delivery across major regions through regional hubs and demand forecasting systems.

- Provides sellers with integrated tools for inventory management, pricing, advertising, and performance tracking at scale.

- Uses advanced data and machine learning models to forecast demand and optimize inventory placement.

- Runs its ecommerce operations on scalable cloud infrastructure that supports peak traffic and order surges.

Walmart

Walmart’s ecommerce platform is an extension of its physical retail footprint. It combines online shopping with store-led fulfillment to offer convenience, affordability, and wide geographic coverage.

Key Features

- Uses its nationwide store network as fulfillment centers, reducing delivery time and improving local availability.

- Offers multiple fulfillment options such as curbside pickup, in-store pickup, and home delivery for customer convenience.

- Integrates real-time store inventory with online listings to improve order accuracy and availability.

- Maintains competitive pricing through efficient supply chain management and large purchasing power.

- Supports a unified shopping experience across physical stores, website, and mobile app.

eBay

eBay operates as a global, seller-first marketplace rather than a traditional retailer. It enables individuals and businesses to sell directly to consumers across a wide range of categories.

Key Features

- Operates a seller-first marketplace model that allows individuals and businesses to sell directly to consumers.

- Supports multiple selling formats, including auctions and fixed-price listings, offering flexibility across categories.

- Has a strong ecosystem for resale, refurbished, and collectible items, making it resilient during price-sensitive demand cycles.

- Enables cross-border trade by connecting global buyers and sellers through localized experiences.

- Relies on seller-managed fulfillment while providing tools for trust, payments, and dispute resolution.

Target

Target’s ecommerce presence focuses on extending brand trust into digital commerce. It emphasizes curated assortments and a consistent shopping experience across online and offline channels.

Key Features

- Extends its offline brand trust into ecommerce through a curated product assortment and strong private labels.

- Provides same-day and curbside pickup options by leveraging store-based fulfillment.

- Maintains a consistent customer experience across online and offline touchpoints.

- Focuses on design-led assortments that balance quality, pricing, and accessibility.

- Offers reliable return and customer support processes to reinforce trust.

Best Buy

Best Buy’s ecommerce platform is built around high-consideration product categories. It combines online purchasing with expert guidance and post-purchase support.

Key Features

- Specializes in electronics and appliances, supporting customers through high-consideration buying decisions.

- Combines ecommerce with expert consultation and in-store or in-home installation services.

- Maintains controlled inventory management for high-value and technical products.

- Uses a hybrid fulfillment model to balance speed, availability, and service quality.

- Emphasizes post-purchase support, including warranties and technical assistance.

Costco

Costco’s ecommerce model reflects its value-driven, membership-based retail philosophy. It prioritizes efficiency, bulk buying, and long-term customer loyalty over assortment expansion.

Key Features

- Operates a membership-based ecommerce model that drives loyalty and repeat purchasing behavior.

- Maintains a limited SKU strategy that simplifies inventory management and improves purchasing efficiency.

- Focuses on bulk buying and value pricing rather than frequent promotions.

- Creates predictable demand patterns through long-term pricing consistency.

- Extends its offline value proposition seamlessly into digital channels.

Home Depot

Home Depot’s ecommerce platform supports both individual consumers and professionals. It is designed to handle complex, project-based purchases that require planning and flexibility.

Key Features

- Supports complex, project-based shopping journeys for both consumers and professionals.

- Offers flexible delivery and pickup options for large, heavy, or specialized items.

- Provides contractor-focused services and tools for repeat and bulk purchasing.

- Maintains deep category expertise in home improvement and construction supplies.

- Integrates online research with in-store fulfillment and assistance.

Wayfair

Wayfair is an online-first retailer focused on home and furniture categories. Its operations are built to manage complex supplier networks and bulky product logistics.

Key Features

- Specializes in furniture and home goods that require complex logistics and handling.

- Operates a supplier-driven inventory model that coordinates directly with manufacturers.

- Supports scheduled delivery options for bulky and high-value items.

- Uses visual discovery and product inspiration as key conversion drivers.

- Relies on coordinated drop-shipping and partner logistics networks.

Etsy

Etsy is a niche marketplace centered on creativity and independent sellers. It enables small businesses and creators to reach global buyers through differentiated products.

Key Features

- Focuses on handmade, custom, and creative products that differentiate it from mass marketplaces.

- Enables independent sellers to build global visibility without holding large inventory.

- Encourages storytelling through detailed listings and personalized offerings.

- Builds trust through community guidelines, reviews, and seller accountability.

- Supports made-to-order and customized products at scale.

Apple (Online Store)

Apple’s online store operates as a direct-to-consumer channel tightly connected to its product ecosystem. It focuses on control, consistency, and premium experience.

Key Features

- Operates a direct-to-consumer ecommerce model with full control over inventory and pricing.

- Integrates product configuration, financing, and checkout into a seamless digital flow.

- Ensures consistency between online and offline purchasing experiences.

- Provides strong post-purchase support through warranties, service programs, and device setup.

- Leverages its broader ecosystem to retain customers across devices and services.

Key Insights from Leading Ecommerce Platforms

Studying the top US ecommerce platforms reveals several clear patterns that define success. Fulfillment has become a competitive differentiator, with platforms investing in integrated logistics networks that ensure faster, more reliable delivery. Marketplaces are evolving into complete commerce ecosystems, providing sellers with tools for payments, advertising, analytics, and shipping, which reduces friction and drives loyalty. Data-driven demand forecasting is increasingly central, helping retailers optimize inventory and respond proactively to changing customer needs.

At the same time, sustainability and operational efficiency are converging, with platforms adopting smarter routing, consolidated deliveries, and eco-friendly packaging to reduce costs and environmental impact. These trends demonstrate that leadership in ecommerce is not just about scale or assortment, it is about executing operations intelligently, reliably, and sustainably.

- Fulfillment is no longer backend infrastructure

It directly influences conversion, retention, and brand trust. - Platforms are reducing seller friction

Tools for shipping, returns, analytics, and customer communication are becoming standardized. - Customer experience extends beyond checkout

Delivery updates, easy returns, and proactive notifications matter as much as UI design.

Industry data from sources like eMarketer and Ecommerce Guide consistently show that platforms optimizing post-purchase operations see higher repeat purchase behavior.

Trends Shaping the Next Phase of US Ecommerce

The US ecommerce landscape is evolving rapidly, and the platforms that dominate today are not just selling more, they are operating smarter. Success now depends on how well a platform can handle complexity, manage scale, and anticipate customer needs. Several clear trends are defining this next phase:

1. Fulfillment as a Strategic Advantage

Delivery speed and reliability have become key drivers of customer loyalty. Leading platforms no longer view logistics as just a cost center, they treat it as a competitive moat. Amazon, for example, continues to invest in micro-fulfillment centers near urban hubs, allowing same-day delivery for millions of products. Similarly, Walmart leverages its physical stores as mini-warehouses, enabling curbside pickup and local deliveries. By controlling fulfillment end-to-end, these platforms not only reduce delays but also gain operational flexibility during peak seasons like Black Friday or holiday sales.

2. Marketplaces as Infrastructure Providers

The role of marketplaces has expanded beyond simply connecting buyers and sellers. Modern platforms provide tools and services that make sellers more successful, which in turn strengthens the platform’s ecosystem.

These services include analytics dashboards to track sales trends, advertising tools to boost product visibility, integrated payments, and automated shipping options. By offering this infrastructure, platforms like eBay and Etsy keep sellers engaged and reduce churn, while also ensuring buyers consistently receive a reliable shopping experience.

3. Data-Led Demand Forecasting

Inventory planning is no longer reactive. The best platforms now use predictive analytics and AI to anticipate demand across regions and categories.

Instead of relying solely on historical sales data, they analyze customer behavior, seasonal trends, and external signals to position inventory closer to where it will be needed. This reduces stockouts, lowers shipping costs, and ensures high-demand products are available during peak periods. Home Depot and Wayfair, for instance, use these insights to manage large, complex product assortments efficiently.

4. Efficiency Meets Sustainability

Sustainability is moving from a “nice-to-have” to a business-critical efficiency measure. Platforms are optimizing routes, consolidating shipments, and redesigning packaging to reduce both operational costs and environmental impact.

For example, companies are combining multiple deliveries into a single trip, reducing miles traveled, and using recyclable or minimal packaging materials. This approach not only lowers emissions but also improves profitability and strengthens brand reputation among eco-conscious consumers.

5. Reliability Drives Loyalty

According to eMarketer, platforms that focus on delivery reliability and customer experience see higher repeat purchase rates compared to those relying mainly on discounts or promotions. Consumers now expect accurate tracking, timely updates, and hassle-free returns, and failure in these areas can quickly erode trust. Platforms that integrate technology, logistics, and customer communication effectively create a self-reinforcing cycle of loyalty, where operational excellence translates directly into long-term revenue growth.

In short, the next generation of US ecommerce winners is defined not just by how many products they sell, but by how seamlessly they operate, how intelligently they plan, and how consistently they meet customer expectations. Platforms that combine fast, reliable fulfillment with data-driven decisions and sustainable efficiency are setting the bar for what modern ecommerce can, and should be.

What This Means for Growing Ecommerce Brands

For Indian D2C brands and enterprises, the lesson from US ecommerce leaders isn’t to copy their platforms, it’s to adopt the mindset behind their operations. Success comes from building systems that scale smoothly without relying on manual processes, ensuring growth isn’t hindered as order volumes rise.

Efficient shipping and tracking are no longer optional, they directly shape customer trust and brand perception. Providing accurate updates and a reliable delivery experience can make the difference between a one-time purchase and long-term loyalty.

As businesses grow, multi-carrier flexibility becomes crucial. Leveraging multiple logistics partners allows brands to handle peak demand, reduce delays, and maintain consistent service quality.

Ultimately, ecommerce is moving toward a model where logistics intelligence drives competitive advantage. It’s not just a cost center anymore, smart operations, data-driven planning, and reliable fulfillment are what separate thriving brands from the rest.

Building Resilient Ecommerce

The success of these 10 platforms shows that ecommerce leadership isn’t about being the loudest or most visible, it’s about flawless execution. Consistency, speed, and reliability are what determine who stays ahead in the long run.

As customer expectations continue to rise globally, the gap between platforms that can scale seamlessly and those that struggle under operational complexity will only widen. What sets the leaders apart is their ability to turn logistics and technology into a strategic advantage rather than a constraint.

For brands looking to navigate this complexity, the time to rethink how ecommerce operations support growth is now, before challenges turn into friction. Solutions that unify fulfillment, tracking, and analytics can make this transition smoother, ensuring operations keep pace with demand while maintaining a superior customer experience.

For those looking to understand how the top US ecommerce websites achieve seamless visibility and shipping efficiency, seeing operations in a real-time tracking dashboard offers a complete view of performance, helping your business stay aligned, informed, and on track at every step of the delivery journey.