In the world of business-to-business (B2B) commerce, traditional methods of managing invoices and confirming deliveries have long been bogged down by manual processes and delayed data flows. Historically, B2B sellers depended on paper invoices, physical signatures on delivery receipts, and siloed systems for accounting and logistics. These fragmented processes often led to delays in billing, prolonged reconciliation cycles, and strained cash flow. As markets expanded and customer expectations evolved, the need for real-time visibility and faster financial operations became clear. Today, digital transformation offers tools to bridge these gaps, allowing B2B sellers to streamline operations and drive growth.

According to The Economic Times, a recent global study, Indian firms are leading in e-invoicing adoption, with more than 80 percent of invoices received electronically, a figure higher than global averages. The same research estimates that full-scale adoption of e-invoicing in India could unlock over ₹32,000 crore in economic value annually and save the average business around ₹1.09 crore each year due to productivity gains, reduced fraud, and quicker payments.

How B2B Transactions Work Today and Where They Fall Short

B2B transactions today involve higher order volumes, tighter margins, and increasingly complex supply chains. Sellers manage multiple buyers, warehouses, transport partners, and payment terms, often spread across cities or regions. While sales volumes have grown, the processes that support invoicing, delivery confirmation, and reconciliation have not evolved at the same pace.

In many B2B sales cycles, goods are dispatched on credit, invoices are raised after delivery confirmation, and payments are settled based on agreed timelines. However, delays in confirming delivery, mismatches between invoices and received goods, and manual reconciliation frequently slow this process down. A missing proof of delivery or an incorrect invoice detail can stall payments for weeks.

Even with the growing adoption of e-invoicing for compliance, many businesses still treat invoicing and logistics as separate workflows. Delivery teams operate independently from finance teams, leading to gaps in information flow. As a result, sellers struggle with delayed invoicing, higher dispute rates, and limited visibility into payment status.

Another challenge lies in scale. As B2B sellers expand into new markets or handle higher shipment volumes, manual or semi-digital processes become difficult to manage. Paper-based proofs of delivery, emailed invoices, and spreadsheet-based reconciliation are not designed for speed or accuracy at scale. These inefficiencies directly impact cash flow and customer experience.

This is where the gap becomes evident. While B2B transactions have become faster and more data-driven on the sales side, post-delivery processes like proof of delivery, invoicing, and reconciliation often remain fragmented. Bridging this gap requires integrating digital delivery confirmation with structured invoicing systems, enabling faster, cleaner, and dispute-free reconciliation.

What Is ePOD and Digital Invoicing and Why Is It Important to B2B?

At the heart of accelerating reconciliation and improving cash flow for B2B sellers are two key technologies: electronic proof of delivery (ePOD) and e-invoicing.

What Is ePOD?

Electronic proof of delivery (ePOD) replaces paper signatures and manual delivery notes with digital records confirming the hand-over of goods. Using mobile devices and specialized software, delivery details, such as timestamps, GPS coordinates, recipient signatures, and photos are captured at the point of delivery and transmitted in real time to central systems.

This instant, verifiable evidence of delivery not only reduces errors and disputes but also creates a seamless link between logistics and financial systems.

What Is e-Invoicing?

E-invoicing is a digital method of creating, issuing, and exchanging invoices in a standardized format that can be automatically processed by business systems and regulatory platforms. This eliminates manual data entry, reduces errors, and speeds up invoice validation. In some markets, such as India, structured digital invoices are now widely used across B2B transactions.

Why These Matter

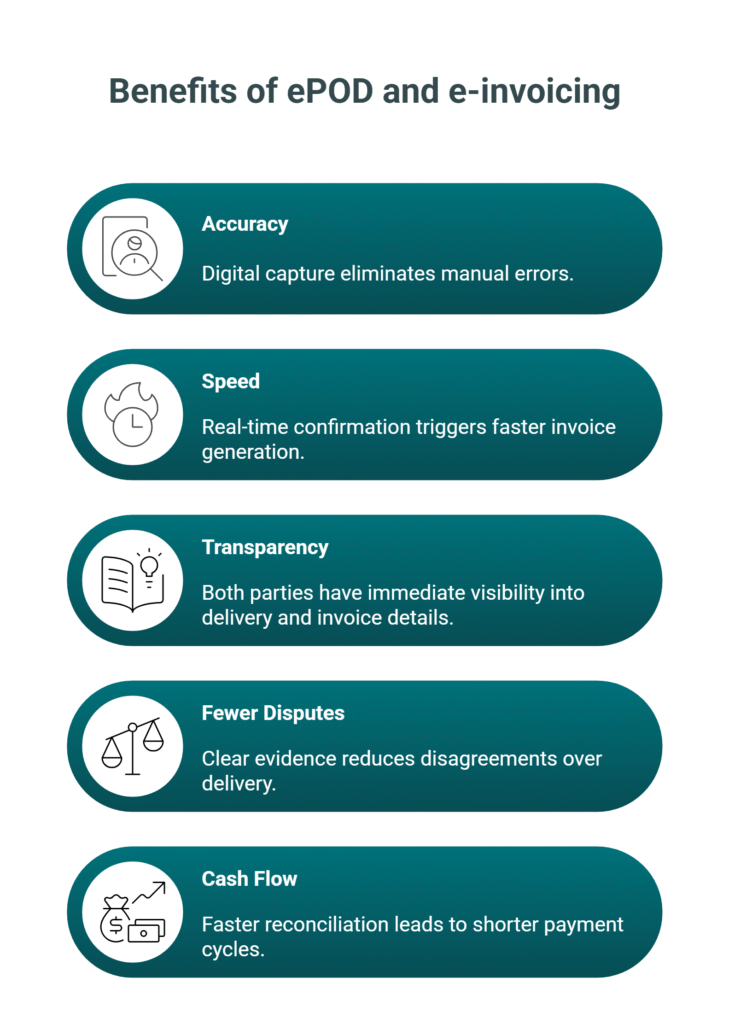

Together, ePOD and e-invoicing solve critical pain points in the reconciliation process:

By digitizing both proof of delivery and invoicing, B2B sellers can automate workflows that once took days or even weeks to finalize.

How Can ePOD Be Implemented?

Implementing ePOD and e-invoicing requires a thoughtful integration of technology, process change, and stakeholder alignment. Here’s a step-by-step guide:

1. Assess Current Processes

Start with a detailed audit of existing invoicing and delivery confirmation workflows. Identify bottlenecks, redundancies, and pain points such as late delivery notices, paper storage issues, or manual reconciliation tasks.

2. Choose the Right Technology

Select software that supports digital proof of delivery and integrates with your accounting and enterprise resource planning (ERP) systems. Look for features like mobile accessibility, real-time data capture, and automated invoice generation.

3. Integrate with Existing Systems

Work with IT teams or third-party vendors to link ePOD and e-invoicing tools with your financial systems. Seamless integration ensures that data flows automatically from delivery confirmation to invoice creation without manual intervention.

4. Train Teams

Equip delivery staff, logistics teams, and finance professionals with training on how to use new digital tools. Successful adoption depends on ease of use and user confidence.

5. Monitor and Optimize

Once implemented, monitor key performance indicators such as time to invoice, reconciliation speed, cash conversion cycle, and dispute frequency. Use this data to refine processes and improve efficiency over time.

Introducing eShipz ePOD Software and Its Benefits

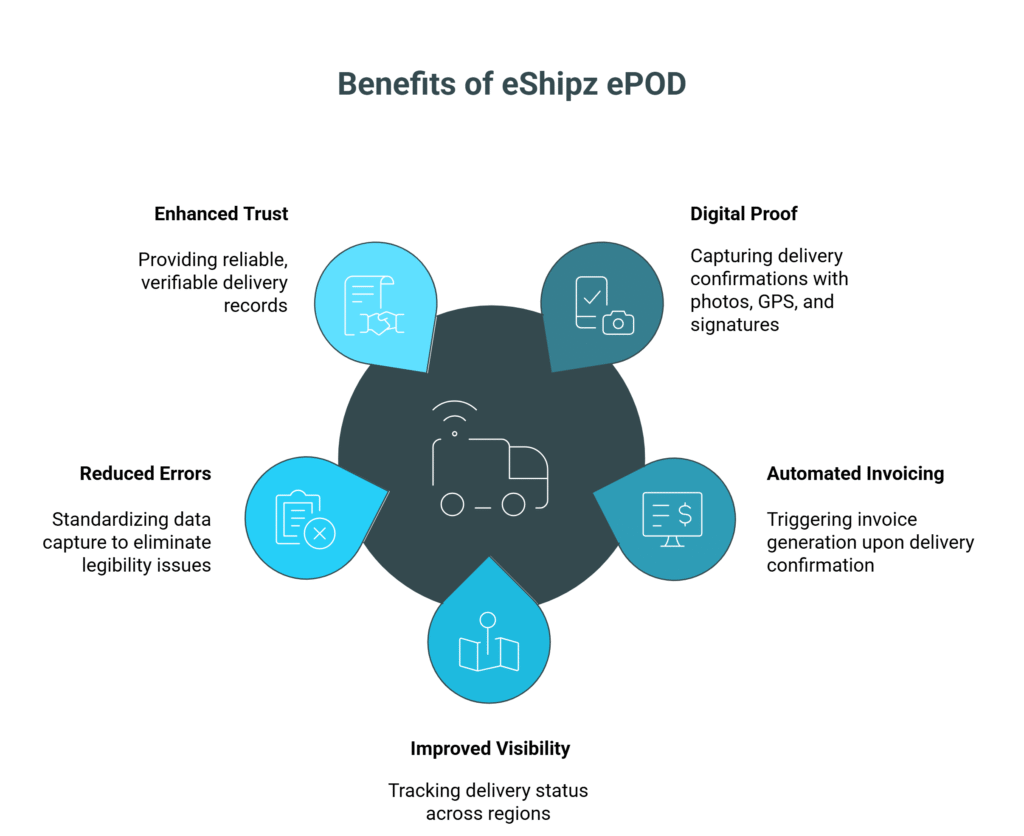

Digital transformation in logistics is more than just a buzzword. Tools like eShipz ePOD software help bridge the physical delivery process with financial operations.

Explore eShipz ePOD software here: https://www.eshipz.com/ai-logistics-proof-of-delivery/

With eShipz ePOD, businesses can:

By combining ePOD with digital invoicing workflows, eShipz helps B2B sellers reduce the gap between delivery and payment, enabling more predictable and efficient revenue cycles.

Preparing B2B Operations for a Digital-First Future

In today’s competitive B2B landscape, companies that continue to rely on manual, disconnected invoicing and delivery processes risk slower reconciliation times, clogged cash flows, and avoidable disputes. Implementing e-invoicing and electronic proof of delivery is no longer an option but a necessity for growth-oriented businesses seeking operational efficiency.

Digitized invoicing and delivery confirmation transform reconciliation from a tedious, error-prone task into an automated, transparent workflow. These technologies shorten payment cycles, reduce paperwork, and deliver real-time insights into business operations. As seen in markets like India, widespread e-invoicing adoption is already generating measurable economic value, underscoring its importance in modern business practices.

For B2B sellers looking to stay ahead, integrating advanced ePOD systems with digital invoicing is a proven strategy for enhancing financial performance and customer satisfaction. Tools such as eShipz ePOD software provide a scalable path to faster reconciliation and stronger cash flow.

Ready to accelerate your reconciliation process? Adopt ePOD and e-invoicing to transform the way you manage deliveries and invoices today, connect with our experts.